BONDING-DEX: Cómo funciona

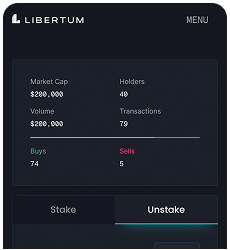

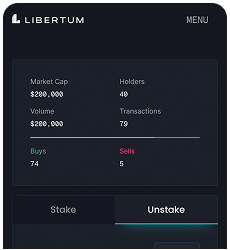

Browse tokenized assets bonded on B-DEX. Review projected yields, staking terms, and governance options.

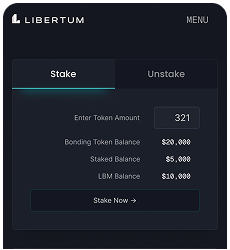

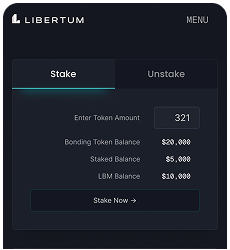

Invest in Real Estate with as little as $100. Stake & Earn: Stake Real Estate in Seconds with just one click.

Rental income is paid in stablecoins like USDCI — pro-rata by stake size and duration.

Tokens remain liquid. Sell, trade, or un-stake anytime. Smart contracts manage claims and payouts.

Undistributed yield buys back RWA tokens, which are then burned — increasing scarcity, long-term value and provides opportunity for token holders to increase their ROI.

Browse tokenized assets bonded on B-DEX. Review projected yields, staking terms, and governance options.

Invest in Real Estate with as little as $100. Stake & Earn: Stake Real Estate in Seconds with just one click.

Rental income is paid in stablecoins like USDCI — pro-rata by stake size and duration.

Tokens remain liquid. Sell, trade, or un-stake anytime. Smart contracts manage claims and payouts.

Undistributed yield buys back RWA tokens, which are then burned — increasing scarcity, long-term value and provides opportunity for token holders to increase their ROI.

Escasez e incentivos combinados

B-DEX usa un modelo de recompra y quema para respaldar el valor de los tokens RWA:

Activos gestionados con IA

Reduce costos operativos

Pools sin KYC

Staking opcional orientado a privacidad

Liquidez instantánea para propietarios

Sin dependencia de finanzas tradicionales

Flexibilidad y accesibilidad

Opera en cualquier momento sin bloqueos

Rendimiento real

Ligado a flujos reales del activo