The first decade of crypto proved what’s possible; the next will prove what lasts. Beneath cycles of speculation, a quieter shift has taken hold: real-world assets moving on-chain via Real World Asset Tokenization. This isn’t about chasing volatility; it’s about upgrading the financial plumbing that moves equity, debt, property, revenue, and funds.

Tokenization isn’t new. What’s new is the convergence of:

- Distributed ledgers (for verifiable ownership and settlement),

- Programmable compliance (so rules travel with assets), and

- On-chain liquidity (so value can move 24/7 within clear guardrails).

In short, the Tokenization of Real World Asset flows is maturing: the result is a finance stack that’s more transparent and efficient without abandoning legal rigor. The signal is getting stronger.

What RWAs Are And Why They Matter Now

Real-World Assets are claimable, cash-flowing, or collateralizable things from the physical/economic world; real estate, treasuries, private credit, revenue streams, infrastructure, commodities, and regulated funds; represented as tokens on-chain (a tokenized real world asset approach).

Tokenization turns these assets into digital primitives that are:

- Divisible: Fractional ownership lowers minimums and broadens access.

- Programmable: Cash flows, redemptions, governance, and who can hold/transfer are codified.

- Transferable: Secondary liquidity without manual, bilateral paperwork.

- Auditable: Provenance, cap tables, and events are recorded immutably.

Why now? Three forces aligned:

- Institutional readiness: Custodians, auditors, and service providers are comfortable with digital rails.

- Regulatory clarity is improving: Jurisdictions are defining how Tokenizing RWA securities and funds may operate.

- DeFi has matured: The focus is shifting from speculative yield to asset-backed, rules-aware liquidity.

DeFi Isn’t an Escape From Institutions; It’s a Reframe

Early DeFi often positioned itself against legacy finance. The durable path is different: encode institutional logic into open rails. That means letting identity, suitability, transfer restrictions, disclosures, and reporting live inside the asset itself, so capital can move faster within the rules, not around them. Platforms that speak both languages, on-chain logic, and off-chain compliance will define the next phase of Real World Asset Tokenization.

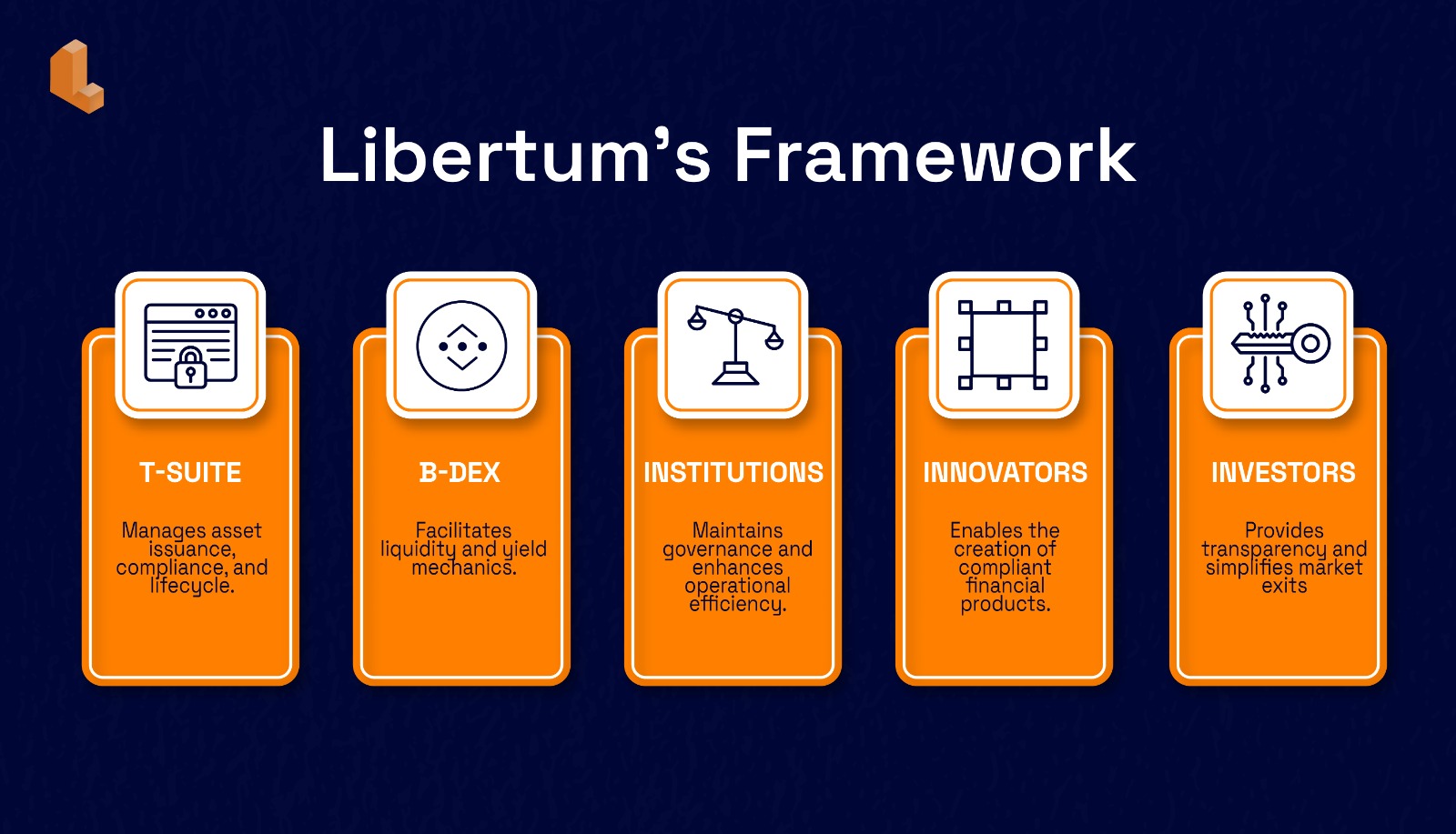

Libertum’s Answer: A Two-Layer Stack Built for RWAs

1) T-Suite - Issuance, Compliance, and Lifecycle Management

T-Suite is Libertum’s framework for taking traditional instruments and expressing them as compliant, programmable tokens. It supports:

- ERC-3643 (security tokens with built-in transfer controls),

- ERC-721 (NFTs for unique rights e.g., property titles, tranches, or permits), and

- ERC-20 (fungible claims for funds, credit pools, or revenue shares).

What it enables for banks, brokers, asset managers, and regulated issuers:

- Tokenize without rewriting your rulebook: map existing equity/debt/fund structures to tokens whose logic enforces your compliance policies, i.e., operational Tokenization of Real World Asset structures.

- Embedded KYC/AML & suitability: investors are verified once; tokens enforce who can hold or receive them.

- Jurisdiction-aware modules: reflect local caps, lockups, marketing rules, and investor classes.

- Issuer operations in one pane: cap table, corporate actions, investor onboarding, document distribution, and audits; anchored on-chain for tokenized real world asset governance.

A practical issuer flow with T-Suite:

- Structure the asset (SPV, trust, or fund) and map it to its on-chain representation.

- Onboard investors (KYC/KYB, accreditation, risk profile).

- Mint tokens with transfer restrictions that honor the rules set (who, when, and how much can move).

- Distribute cash flows (coupons, rents, revenue share) programmatically, often in stablecoins.

- Report automatically (cap-table updates, corporate actions, disclosures) with on-chain proofs.

The aim isn’t to replace institutional infrastructure. It’s to extend it with programmable rails for scalable Tokenizing RWA operations.

2) B-DEX - Liquidity as a Service for Tokenized RWAs

Issuance is only half the story; the other half is continuous, compliant liquidity. B-DEX is Libertum’s liquidity layer designed for RWAs:

- AI-managed bonding curves: Price discovery that adapts to demand, supply, and asset performance inputs.

- Programmable yield mechanics: Distribute yields (e.g., rent, coupons, revenue) in stablecoins directly to token holders.

- Non-fragmented liquidity: Unify staking, market-making, and secondary trading so issuance and liquidity reinforce each other.

- Exit logic by design: Create orderly redemption/exit options that align with the asset’s real-world settlement rhythm.

This is where Real World Asset Tokenization meets live markets: asset-backed tokens become active participants in DeFi while preserving the controls institutions require.

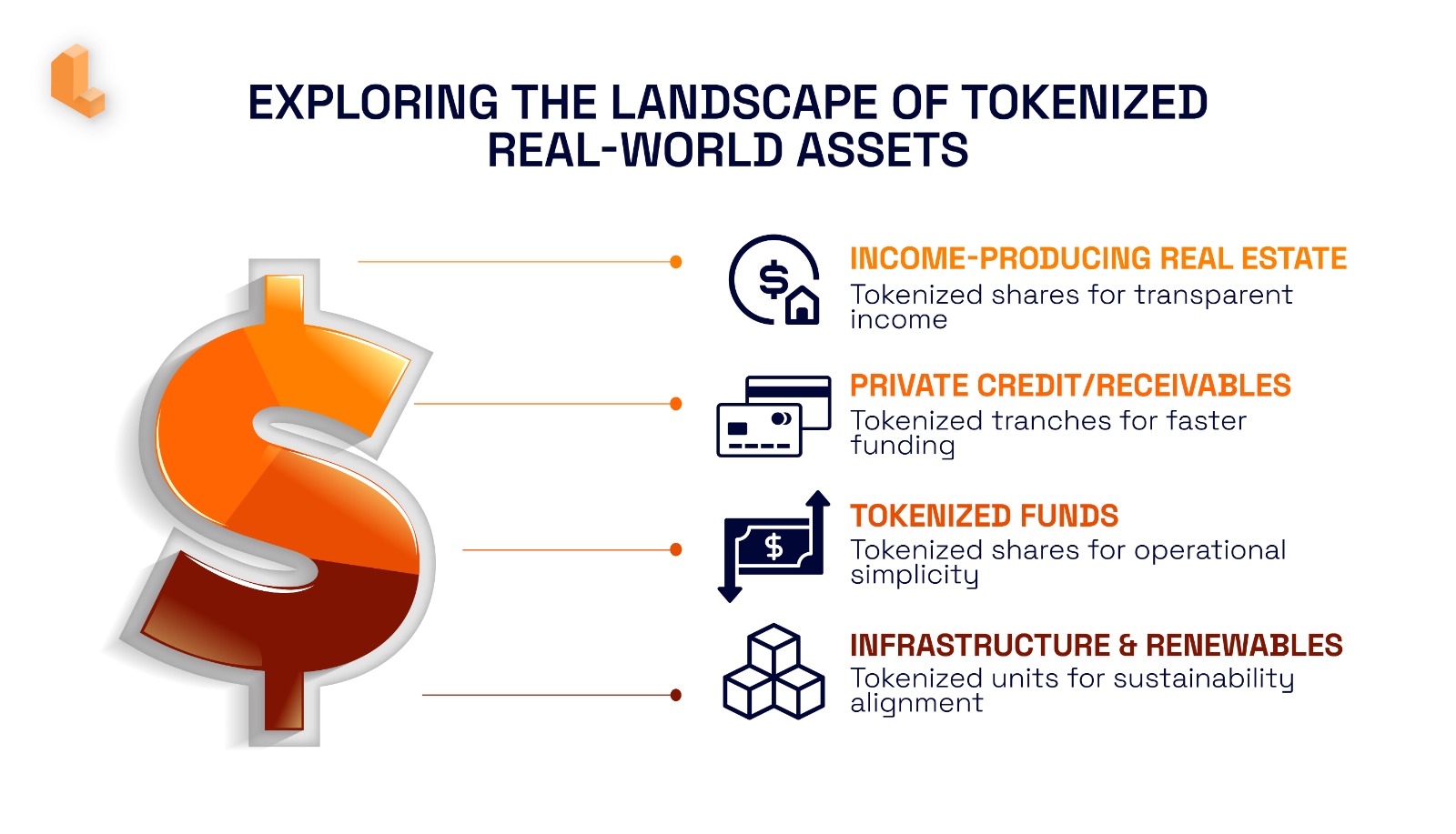

Where RWAs Shine: Concrete Use Cases

Income-Producing Real Estate

- Token: ERC-3643 or ERC-20 representing shares/units.

- Flows: Monthly net rent distributed as stablecoins; on-chain NAV snapshots; controlled secondary transfers.

- Benefit: Lower ticket sizes, transparent income, potential 24/7 secondary markets via tokenized real world asset rails.

Private Credit / Receivables

- Token: Tranches as ERC-20; collateral receipts as ERC-721.

- Flows: Coupon schedules and waterfall rules encoded; borrower payments streamed to holders.

- Benefit: Faster funding cycles; automated servicing; auditable performance—core goals of Tokenization of Real World Asset portfolios.

Tokenized Funds (Feeder/Access Vehicles)

- Token: ERC-3643 fund shares with transfer restrictions.

- Flows: Subscriptions/redemptions, gates, and lockups enforced in token logic; reports broadcast to holders.

- Benefit: Operational simplicity for managers; better transparency for LPs; practical Tokenizing RWA mechanics.

Infrastructure & Renewables

- Token: Project units linked to verifiable generation data.

- Flows: Revenue share tied to metered output; “proof of generation” oracles.

- Benefit: Align capital with sustainability outputs; enable retail access where allowed through Real World Asset Tokenization pathways.

Risk, But Designed for Resilience

Honest systems acknowledge constraints and encode protections.

- Regulatory alignment: use whitelists/allowlists, investor categories, transfer controls, and geo-fencing at the token level.

- Valuation integrity: bind pricing logic to attested oracles and audit trails; document methodologies investors can verify.

- Liquidity mismatch: design redemption windows, gates, and bonding-curve parameters that reflect real settlement times.

- Custody & key management: enterprise-grade custody for institutions; hardware-wallet support for individuals; role-based controls for operators.

- Data & disclosure: keep offering docs, risk factors, and financials accessible and hash-anchored for provenance.

Libertum’s stack treats these not as afterthoughts, but as first-class modules of tokenized real world asset design.

Interoperability: The Real Edge

A token is only as useful as the ecosystem it can speak to.

- Wallet compatibility: standards-based tokens work with mainstream wallets while honoring compliance rules.

- Composability: dashboards, analytics, and reporting tools can subscribe to on-chain events.

- Bridging to DeFi: allowlisted pools and curated venues can support compliant secondary activity for Tokenizing RWA products.

- Off-chain integrations: connect registrars, transfer agents, fund admins, and auditors so the same truth is visible to all parties.

A Practical Blueprint: From Asset to On-Chain Liquidity

For Issuers

Define the legal wrapper → Configure compliance rules → Onboard investors → Mint and allocate tokens → Automate cash-flow schedules → Enable B-DEX liquidity. (An end-to-end Real World Asset Tokenization workflow.)

For Investors

Verify identity & suitability → Subscribe digitally → Hold compliant tokens → Receive stablecoin yields → Trade/redeem within defined parameters → Monitor performance on-chain—hallmarks of a mature tokenized real world asset ecosystem.

Why This Model, Why Now

- Public sector signals: governments and central banks are piloting tokenized instruments and rails.

- Institutional pilots: fund managers are launching tokenized feeders and credit strategies.

- User expectations: investors expect real-time visibility, not quarterly PDFs.

- Technology maturity: the toolchain finally supports policy-as-code at scale for Tokenization of Real World Asset programs.

Tokenization isn’t a silver bullet. It’s a container for rethinking how value is structured, accessed, and governed; bringing the discipline of regulated finance to the speed and transparency of open systems.

How Libertum Fits

Libertum pairs T-Suite (issuance + compliance + lifecycle) with B-DEX (liquidity + yield mechanics) so every stage from onboarding to secondary markets is consistent with the rules that govern the asset.

- For institutions: keep your governance intact; gain efficiencies in distribution, servicing, and reporting.

- For innovators: build new products (revenue-share instruments, real-time coupons, dynamic tranches) with compliance woven in using Tokenizing RWA blueprints.

- For investors: clearer disclosures, programmatic income, and simpler exits—within the boundaries that protect markets.

From Noise to Structure

The question isn’t “can we put assets on-chain?” We already can. The right question is how we should, and why. The durable answer blends infrastructure, interoperability, and a clear philosophy: let compliance become code, let yields stream when value is created, and stop making liquidity wait for banker’s hours.

If you’re exploring this shift, look for builders prioritizing substance over spectacle. Libertum is one of them; quietly laying rails for what’s next in Real World Asset Tokenization.

Ready to see it in action?

- Issuers/Managers: Explore how T-Suite maps your existing structures to programmable tokens without reinventing compliance (a pragmatic Tokenization of Real World Asset path).

- Liquidity Leads: Evaluate how B-DEX can provide orderly, rules-aware liquidity for your assets within a tokenized real world asset marketplace.

Book a walkthrough or request a sandbox demo to model your first Tokenizing RWA offering and its liquidity parameters.