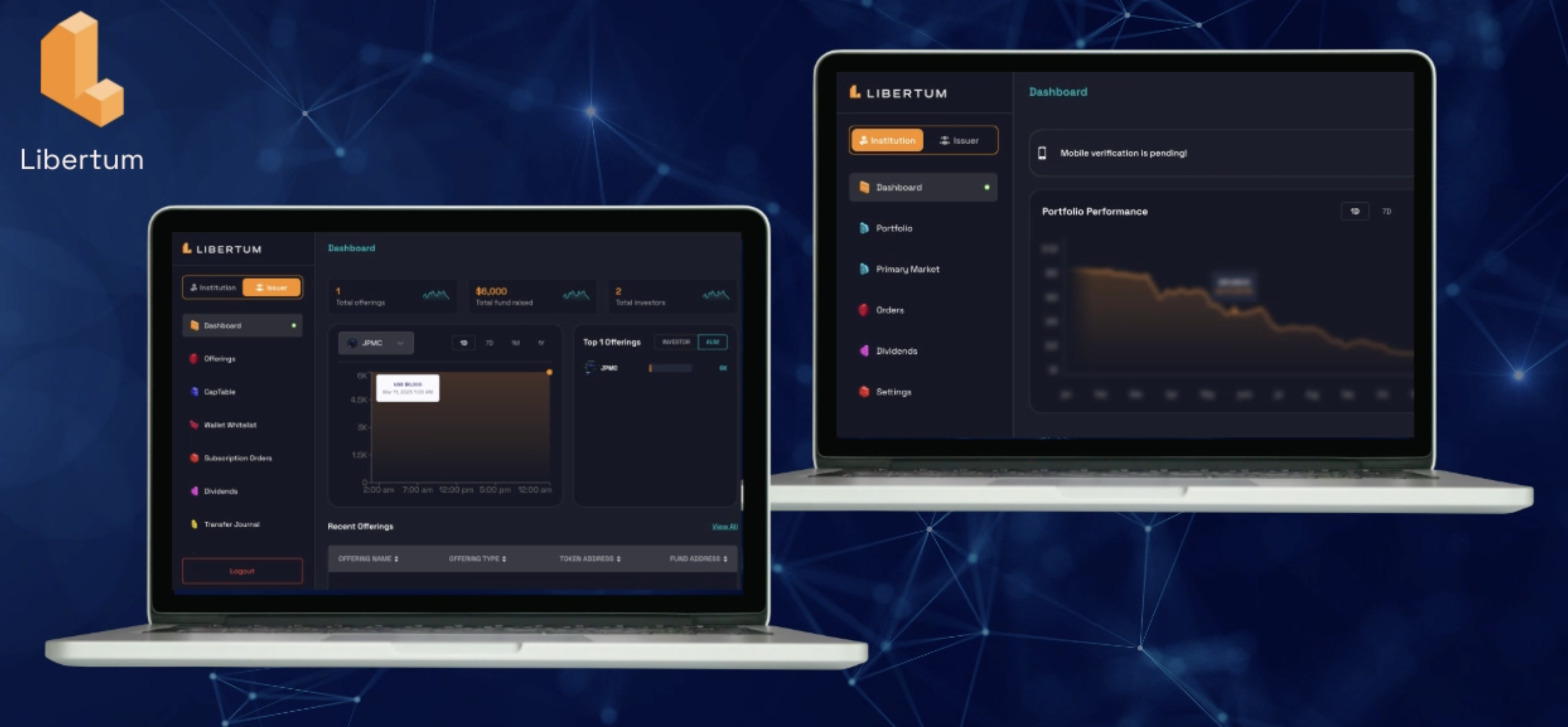

Libertum, a global leader in blockchain-based financial solutions, has officially launched its next-generation tokenization engine — a cutting-edge platform designed to seamlessly connect traditional finance with decentralized technology. This innovation simplifies the tokenization of real-world assets (RWA), unlocking greater liquidity, transparency, and accessibility in global markets.

By leveraging the ERC-3643 standard for compliant security tokenization and ERC-721 for NFT asset management, Libertum’s engine provides a regulation-ready infrastructure for institutions, businesses, and investors. It enables secure, large-scale asset tokenization, trading, and management, with built-in support for both fiat and crypto payments. By merging institutional-grade investments with blockchain technology, Libertum is making global financial opportunities more accessible than ever.

Redefining Real-World Asset Tokenization

Libertum’s tokenization engine allows businesses and investors to fractionalize ownership of high-value assets like real estate, private equity, and collectibles. By transforming traditionally illiquid markets into dynamic, accessible opportunities, it opens the door to greater investment flexibility. With a strong focus on regulatory compliance and cutting-edge blockchain technology, Libertum is redefining the standard for asset tokenization.

Key Features of Libertum’s Tokenization Engine

- Regulatory Compliance: Built-in on-chain KYC/AML verification ensures that only authorized participants can interact with tokenized assets, maintaining the highest security and compliance standards.

- Multi-Asset Support: The platform supports ERC-3643 security tokens for regulated assets like real estate, equities, and bonds, alongside ERC-721 NFTs for unique asset ownership, including art and collectibles.

- Seamless Liquidity: Integration with Libertum’s RWA Bonding DEX provides instant market access, allowing investors to enter and exit tokenized asset positions with ease.

- Smart Contract Efficiency: Automated, self-executing agreements streamline key processes such as dividends, revenue sharing, and asset transfers, reducing inefficiencies in traditional markets.

- Global Accessibility: With support for both fiat and crypto payments, Libertum makes tokenized asset markets accessible to investors worldwide.

A Leap into the Future of Financial Opportunities

Libertum is dedicated to making institutional-grade investments more accessible while maintaining the highest standards of compliance, security, and efficiency. This launch marks a significant milestone in bringing real-world assets on-chain, enabling fractional ownership, transparent transactions, and innovative liquidity solutions.

“The launch of our tokenization engine represents a transformative moment for the financial industry,” said Javvad Azam, CEO at Libertum. “We are not just enabling tokenization — we are redefining how assets are owned, traded, and leveraged globally. By combining regulatory compliance with cutting-edge technology, Libertum is paving the way for a more inclusive and efficient financial ecosystem.”

Real-World Applications

Libertum’s tokenization engine is already being adopted across multiple industries:

- Real Estate: Developers can fractionalize property ownership, allowing smaller investors to participate in high-value projects.

- Private Equity: Businesses can tokenize equity shares, unlocking new funding opportunities and providing liquidity for stakeholders.

- Art and Collectibles: Collectors can tokenize rare artworks, opening up new markets and increasing liquidity for unique assets.

What’s Next for Libertum?

With its cutting-edge tokenization infrastructure now live, Libertum is gearing up to expand its ecosystem by introducing RWA Bonding DEX solutions in Q2 2025. These solutions will further enhance liquidity and market access for tokenized assets, reinforcing Libertum’s position as a leader in the tokenized finance revolution.

About Libertum

Libertum is a global tokenization company dedicated to reshaping real-world asset markets through blockchain technology. With a strong focus on regulatory compliance and innovation, Libertum’s platform bridges the gap between traditional finance and decentralized solutions, empowering institutions and investors to unlock new financial opportunities.

For more information, visit www.libertum.io.

Media Contact

Martha Lucia

[email protected]

www.libertum.io