The idea of tokenized real estate is appearing more and more in news articles, regulatory reports, and startup pitches. But for many property owners, it still feels abstract. What does it really mean to tokenize your property? And why should developers, landlords, or fund managers pay attention?

This guide explains the process in clear terms. It is written for people who don’t need the technical jargon but want to understand how tokenized real world asset models work, why they matter, and what to consider before moving forward.

What Does Tokenization Mean?

When we talk about tokenization in real estate, we mean creating a digital version of ownership rights for a property on a blockchain. These tokens can represent equity shares, rental income rights, or investment stakes in a project.

It’s not about making your building virtual. A hotel or apartment block doesn’t disappear into cyberspace. What changes is how its ownership and financial rights are represented. Tokens act as digital certificates of ownership, backed by legal frameworks and recorded on secure, programmable ledgers.

In short, learning how to tokenize your property means learning how to turn property rights into small, tradeable units that are easier to manage and sell.

Why Tokenize Property?

There are strong reasons why tokenized real world asset models are gaining traction in real estate:

- Access to Capital: Instead of waiting for one large buyer, you can raise funds by selling smaller tokenized units to many investors.

- Liquidity: Traditional property sales can take months. With tokenization, investors can trade tokens quickly on compliant exchanges.

- Efficiency: Smart contracts automate tasks—payouts, compliance checks, reporting—saving time and costs.

- Global Reach: Once your property is tokenized, international investors can participate without heavy paperwork.

For property owners, these benefits mean faster fundraising, easier investor management, and more opportunities to expand.

What Types of Property Can Be Tokenized?

How to tokenize your property depends on what kind of asset you own. Examples include:

- Rental portfolios with recurring income

- Commercial developments like offices or retail centers

- Mortgages and structured debt

- Undeveloped land with future rights

- Equity in SPVs (special-purpose vehicles) that hold physical assets

Each of these can become a tokenized real world asset, provided the legal and regulatory structures are in place.

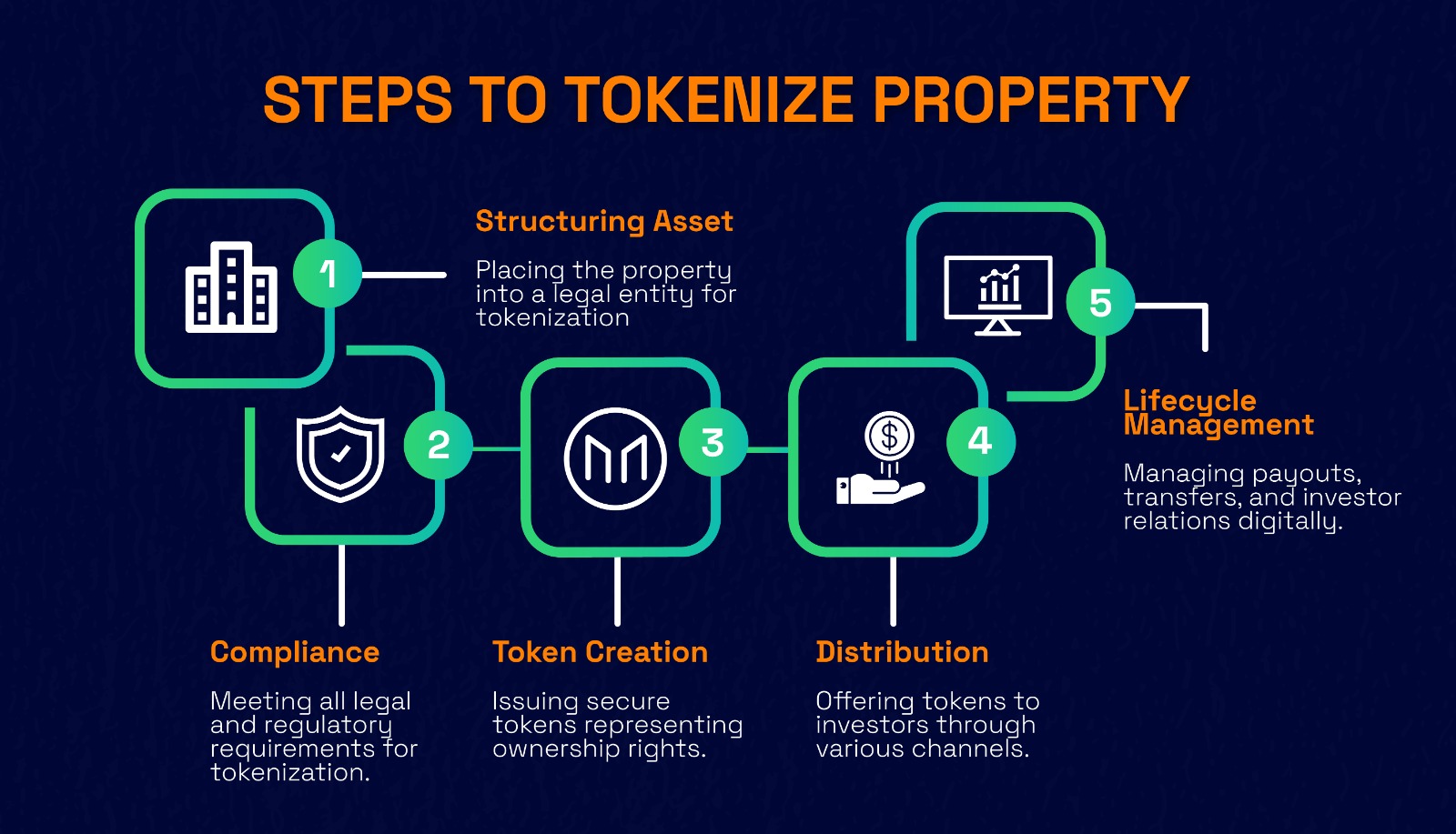

The Tokenization Process Step by Step

- Structuring the Asset – Place the property into a legal entity (trust or SPV).

- Compliance – Meet AML/KYC and investor protection requirements.

- Token Creation – Issue secure, standards-based tokens (e.g., ERC-3643).

- Distribution – Offer tokens via placements, crowdfunding, or digital marketplaces.

- Lifecycle Management – Manage payouts, transfers, voting, and investor relations digitally.

When done right, tokenization makes ownership more flexible, efficient, and transparent.

How Libertum Helps

Most owners don’t have the time or expertise to handle tokenization on their own. That’s why Libertum exists.

Through its T-Suite platform and B-DEX bonding exchange, Libertum provides:

- Simple token creation and compliance management

- Secure issuance of tokenized real world asset products

- Access to global investors via compliant secondary trading

- Automated tools that save time and reduce costs

Instead of struggling with complex steps, owners can use Libertum to tokenize property in a secure, transparent, and investor-friendly way.

Things to Consider Before Tokenizing

Before starting, property owners should ask:

- Is the property legally ready (ownership/title clear)?

- Is there investor demand for this type of property?

- Am I ready for ongoing responsibilities like compliance and investor updates?

Tokenization doesn’t remove responsibility—it transforms how it is handled.

Final Words: A New Era for Property Owners

Real estate is moving into a new chapter where ownership is not locked behind slow paperwork and local markets. By learning how to tokenize your property, you unlock faster capital, wider investor pools, and smarter management tools.

Not every property will be suitable, but for those ready to take the step, tokenization offers benefits that go beyond liquidity. It’s about creating a property that can compete in a more digital, global market.

With Libertum, you don’t have to do it alone. The platform gives you the technology, compliance, and market access to create your first tokenized real world asset with confidence.

👉 Ready to explore tokenization with Libertum? Book a Demo Today