If you’ve been watching Real World Asset Tokenizationfrom the sidelines, this is your on-ramp. In a few minutes, you’ll learn how to acquire a tokenized real world asset exposure on Libertum’s B-DEX, stake it to start earning USDC rewards, and manage liquidity without getting lost in jargon or risky shortcuts.

Why now? Because the rails have matured. Tokenization of Real World Asset programs can encode compliance (KYC/KYB, transfer rules, jurisdictions) directly into the token, while B-DEX supplies orderly, 24/7 liquidity designed for assets that live in the real economy. You get the speed of DeFi with the discipline institutions require.

We’ll start with what you need (wallet + funds on Base), then walk you through bonding a token (e.g., BH100 = $100 each), staking to earn USDC, and using exit options responsibly. Along the way, we’ll flag common hiccups and how to fix them fast.

Key Points:

- You’ll fund a Base-network wallet with USDC (plus a little ETH for gas), visit B-DEX, buy a Bonding Token (e.g., BH100), then stake it to start earning USDC rewards.

- Liquidity is available 24/7 (subject to each program’s rules). Always review the token card and disclosures before investing.

On-chain investing can feel complex the first time - networks, bridges, bonding, staking, APY, fees. This guide removes the guesswork with a practical journey you can follow end-to-end, while keeping compliance and risk awareness front and center.

Use the 9-step Workflow to Invest Safely & Simply:

Step 1: Fund your wallet with USDC on Base

If your USDC is on another network (Ethereum, Polygon, etc.), bridge or swap to Base. Keep $5–$10 worth of ETH (Base) for gas.

Step 2: Open B-DEX: The RWA Bonding DEX

Navigate via the official Libertum link [<https://www.libertum.io/](https://www.libertum.io/). You’ll see live bonding pools, token cards, and a Connect Wallet button.

Step 3: Connect your wallet on Base

Click Connect → select your wallet → switch to Base when prompted.

Step 4: Select the Bonding Token (e.g., BH100)

A Bonding Token represents structured exposure to a real-world asset program.

- Example: BH100, where each token is priced at $100 at bonding.

- The token card shows price, pool size, eligibility, and any lock/exit rules.

Step 5: Choose your amount

Enter the number of tokens to preview your total.

- Example: 10 × BH100 = $1,000 USDC.

- You’ll see the indicative yield: Earn ~X% APY in USDC. (APY varies by program.)

Step 6: Confirm & Buy

Click Bond / Buy and sign the transaction.

- Ensure you’ve approved USDC spending (first-time only).

- Keep a little ETH (Base) for gas.

Step 7: Wait for bonding settlement

Your USDC is exchanged for Bonding Tokens per the pool’s programmed curve and rules. You’ll see the new balance in Portfolio.

Step 8: Stake your Bonding Token

Go to Staking, select the same Bonding Token, and Stake.

- Staking starts the USDC rewards accrual per program logic.

Step 9: Earn APY & access liquidity 24/7

- Claim rewards on schedule.

- Unstake anytime (subject to rules).

- Trade on B-DEX; if a pair exists, some tokens may also have liquidity on Uniswap.

What is “Bonding,” and Why Use it for RWAs?

Bonding applies a programmed pricing curve with guardrails to create predictable entry/exit around real assets. It can:

- Reduce listing/market-making friction for new RWA Tokenizationprograms.

- Encode fairness (caps, gates, cooldowns) at the smart-contract level.

- Enable 24/7 participation without sidestepping compliance.

In short: bonding brings market structure to Asset Tokenization, especially for tokenization real estateofferings that need clear rules and orderly liquidity.

Safety, Compliance & Best Practices

- Complete KYC/eligibility checks where required

- Read each token card (fees, lockups, yields)

- Use hardware wallets for larger allocations

- Keep ETH for gas; adjust slippage reasonably

- Check jurisdictional availability

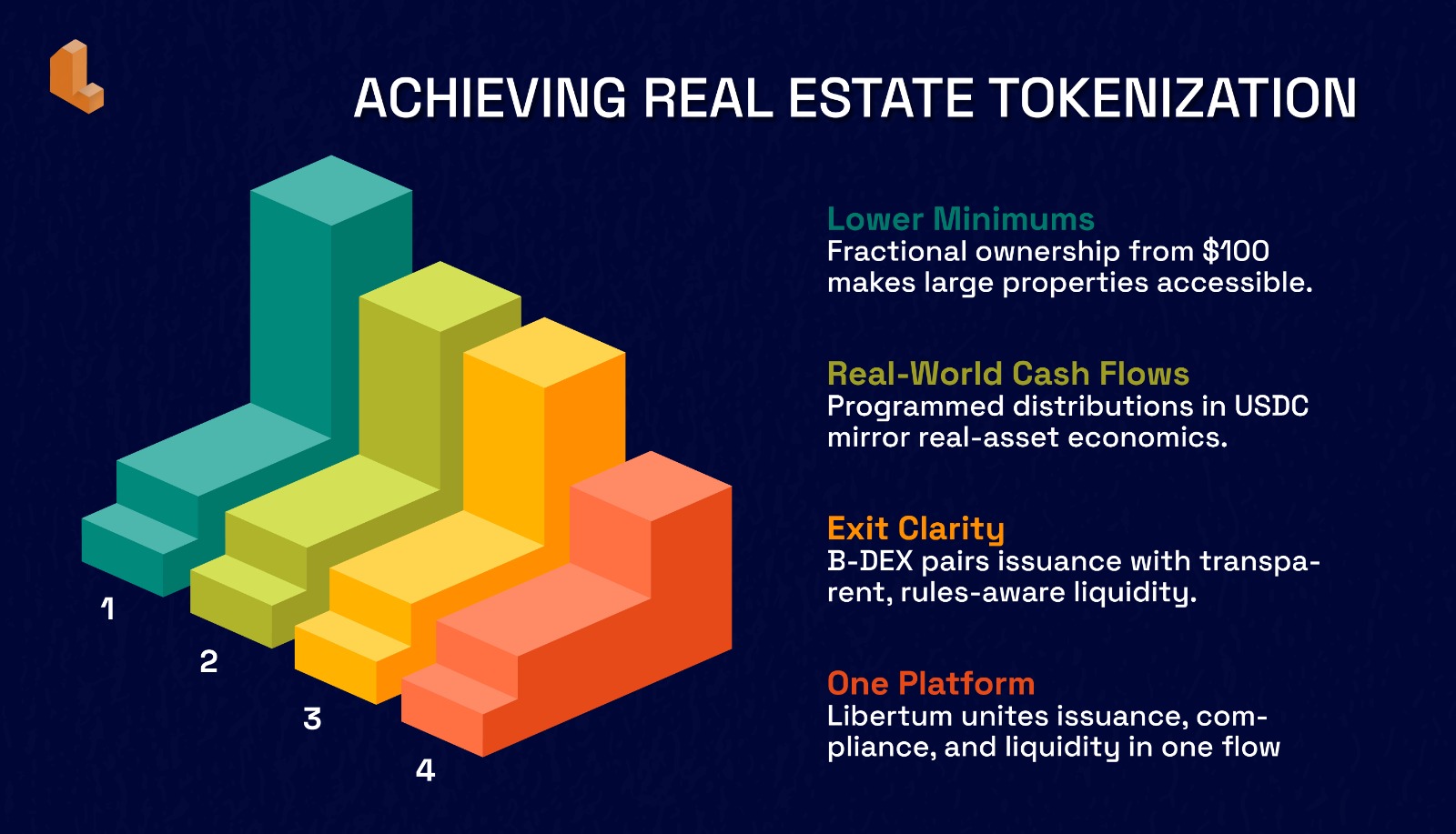

Why This Matters for Real Estate Investors

- Lower minimums → invest from $100

- Real-world cash flows → USDC rewards tied to actual economics

- Exit clarity → B-DEX pairs issuance with transparent liquidity

- One platform → Issuance, compliance, and liquidity united

Closing Thoughts

Libertum’s stack pairs compliant issuance with always-on liquidity; policy-as-code for RWA Tokenization. For investors, that means a straightforward, repeatable path; for issuers, a consistent user experience aligned with the rules of Tokenizing RWA. As tokenization real estate and broader Asset Tokenization markets mature, this step-by-step workflow is how on-chain investing actually becomes usable at scale.

Ready to try it?

Open B-DEX, connect on Base, start with a small test bond, and stake. Prefer a guided session or planning your own RWA program on a real estate tokenization platform? Book a demo with the Libertum team.