In less than six months, Libertum has transitioned from vision to velocity. With its mission to make real-world asset (RWA) tokenization accessible, compliant, and scalable, the company has quietly built one of the most powerful infrastructures in Web3 — and it’s only just begun.

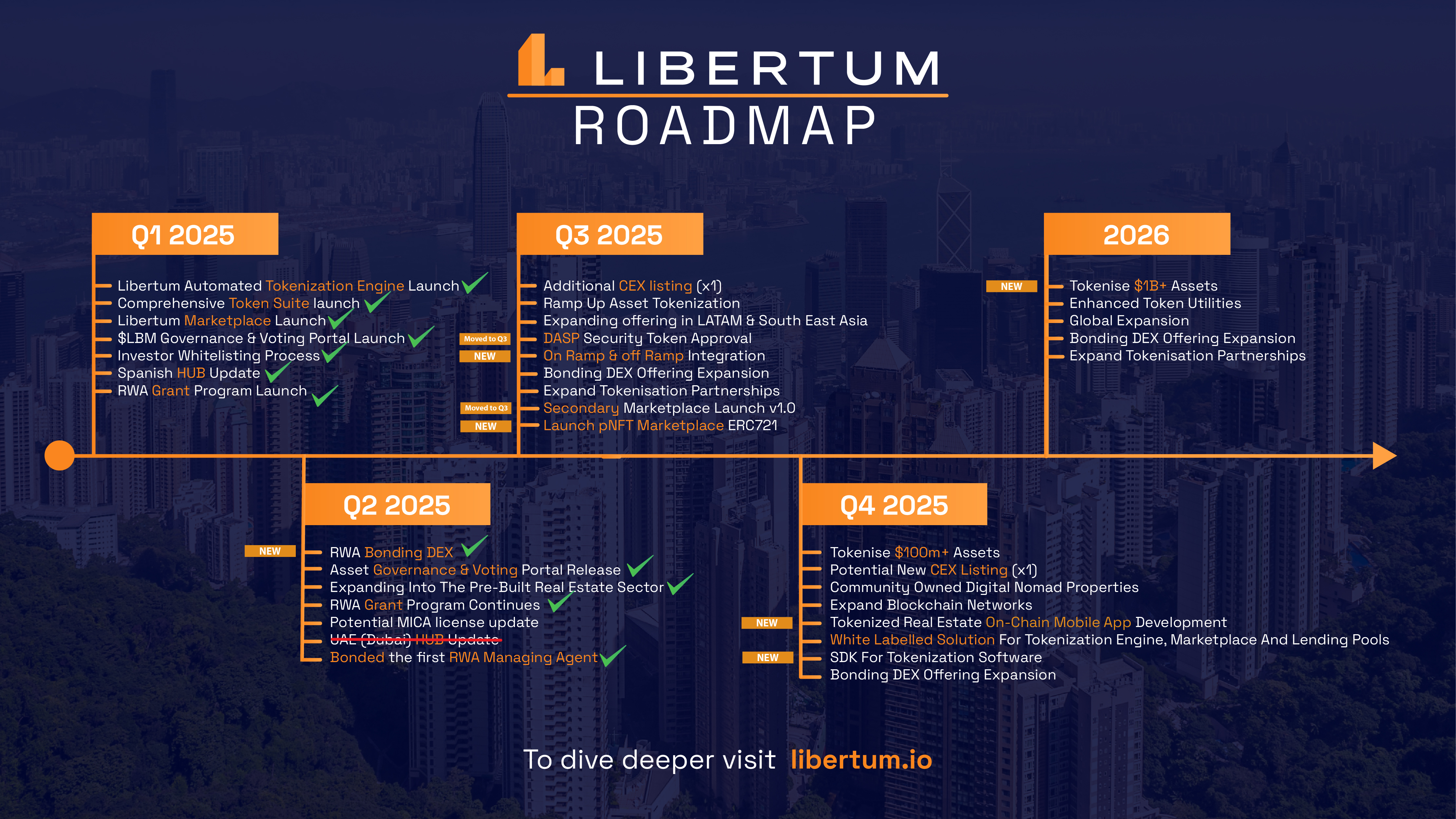

Today, we unveil our official 2025 roadmap, celebrate the milestones we’ve achieved, and share the blueprint for what’s coming.

⸻

✅ Q1 2025: Laying the Foundation

We began the year by building the core infrastructure for on-chain asset issuance, ownership, and trading.

Here’s what we achieved:

• ✅ Launch of the Automated Tokenization Engine (ERC-3643)

• ✅ Rollout of the Comprehensive Token Suite

• ✅ Release of the Libertum Marketplace for on-chain asset offerings

• ✅ Launch of the $LBM Governance & Voting Portal

• ✅ Deployment of the Investor Whitelisting & Compliance Layer

• ✅ Activation of the Spanish HUB

• ✅ Introduction of the Libertum RWA Grant ProgramThe groundwork was set to tokenize anything, anywhere — and with full compliance.

⸻

🔥 Q2 2025: The First Real-World Bonding DEX

In Q2, we moved from token issuance to token utility and liquidity. We launched the world’s first RWA Bonding DEX (B-DEX), enabling compliant assets to be traded and staked — unlocking yield, transparency, and value.

Highlights include:

• ✅ Launch of B-DEX (Bonding Decentralized Exchange)

• ✅ Asset Governance & Voting Portal release

• ✅ Entry into the Pre-Built Real Estate tokenization market

• ✅ Continuation of the RWA Grant Program

• ✅ Bonding of the first AI-powered RWA Managing Agent (JVC100)With each success, we’ve proven that real estate and infrastructure can live on-chain — securely, legally, and transparently.

⸻

⚠️ What We’ve Paused

In the spirit of transparency, here are initiatives we’ve strategically placed on hold:

• ❌ MiCA license pursuit – Evaluated, deprioritized due to evolving regulatory timelines.

• ❌ Dubai HUB expansion – Shelved to focus resources on LATAM and SEA.

• ❌ Additional CEX Listing – Deferred due to current market dynamics.We’re laser-focused on building where the impact is greatest.

⸻

🎯 Q3 2025: Global Expansion & New Market Entry

As we move into Q3, the goal is scale and market penetration. We’ll onboard more asset classes, expand into LATAM and Southeast Asia, and activate full on/off-ramp capabilities.

Coming soon:

• 🚀 Ramp-up of global asset tokenization onboarding

• 🌎 Expansion into LATAM & Southeast Asia

• 🛡️ Approval for DASP Security Token licensing

• 💳 On-ramp/off-ramp integrations with Transak, Inabit & Circle

• 📈 Expansion of offerings on Bonding DEX

• 🤝 Growth in white-label tokenization partnerships

• 🔄 Launch of Secondary Marketplace v1.0

• 🖼️ Release of pNFT Marketplace (ERC-721)We’re now serving not just asset owners — but also developers, projects, governments, and real estate groups worldwide.

⸻

🚀 Q4 2025: Scaling Through Product & Protocol

The final quarter of 2025 is all about deepening the ecosystem and expanding tools for partners and users.

Our goals include:

• 🏗️ Tokenize $100M+ in assets

• 🏡 Launch community-owned digital nomad properties

• 🌐 Expand across multiple blockchain networks

• 📲 Begin development of on-chain mobile real estate app

• 🤝 Rollout of white-label suite for:

• Tokenization Engine

• Custom Marketplaces

• Lending Pools

• 📦 Launch SDKs for developers

• 📈 Expand listings & liquidity on Bonding DEX

• 💱 Re-evaluate CEX listing strategyBy year’s end, we aim to be the default OS for tokenizing the real world.

⸻

🌍 2026: The Billion Dollar Vision

In 2026, we aim to tokenize over $1B+ in real-world assets while expanding globally and enhancing token utility across the ecosystem.

Key ambitions include:

• 💵 $1B+ in tokenized assets

• 🌍 Global market penetration across 6+ regions

• 🔁 Cross-chain compatibility with rollups & L2s

• ⚙️ Enhanced $LBM utilities & DeFi integrations

• 📈 B-DEX to become a core gateway for DeFi-powered RWA yield

• 🧠 AI-powered smart contract agents to manage RWA portfoliosThe future is real, liquid, and on-chain — powered by Libertum.

⸻

🧱 Final Thoughts

In 2025, tokenization isn’t a trend — it’s the next evolution of capital markets. Libertum is proving that real-world assets, once slow and illiquid, can now be as flexible and programmable as any digital asset.

With our ecosystem of tools, smart contracts, compliance systems, and marketplaces — we’re building a financial future where anyone, anywhere can access yield-generating, transparent real-world assets.

And we’re just getting started.

⸻

📩 Want to tokenize your assets?

🌐 libertum.io

🐦 @libertum_io

📍 London | Dubai | El Salvador | Mexico City